India’s cooling energy market: A bundle of opportunities

India is one of the key markets for Kamstrup in the cooling energy segment. Since 2006, Kamstrup has been building a legacy of long term performance and maintenance free ultrasonic cooling meters, with an unparallel quality and reliability in the market.

India is one of the key markets for Kamstrup in the cooling energy segment. Despite of being the fifth largest economy with US$ 2.94 trillion,(1) India continues to be a developing economy. The GDP per capita of India is US$ 2,171(1) with a huge population of 1.38 billion. By area, it is the 7th largest country in the world. In this blog, we try to offer a bird’s eye view into the Indian cooling energy market and the business opportunities from Kamstrup’s sales manager perspective. The average temperature in India has increased from 25.61°C in 2012 to 26.05°C in 2019(2). Moreover, a large portion of the country faces extreme summers with temperatures going as high as 50 degree Celsius.

Hence with reference to BTU energy consumption, India is more of cooling meter market. There is very little demand for heat meters and that too primarily in northern part of the country.

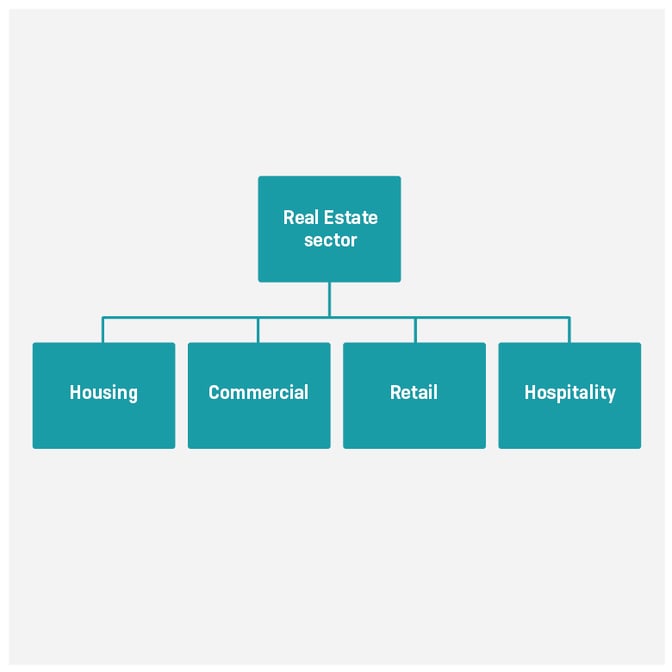

Also, the development of cooling market in India depends on the growth trajectory of real estate sector. Hence, it is important to take a closer look at the real estate market in India.

Real estate market in India

Real Estate is one of the key driving factors behind the growth of the Indian Economy and plays a pivotal role in the nation’s GDP growth. It consists of 4 sub-sectors – Housing, Commercial, Retail, and Hospitality.

The real estate sector in India is expected to reach a market size of US$ 1 trillion by 2030 from US$ 120 billion in 2017 and contribute 13% of the country’s GDP by 2025(3).

Housing Sector

As per one report, out of the 2,30,000 new unit launches in 2019 in the top 7 cities, nearly 40% or approximately 92,000 units were in the affordable segment, followed by mid-segment with a 33% share. The luxury and ultra-luxury segments amounted to the least share with 10% (approximately 23,000 new units). Housing sales in 2019 saw a modest 4-5% annual growth with over 2,58,000 homes sold during the year and new housing launches in 2019 saw an 18-20% annual growth(4).

Commercial Sector

Office leasing increased by more than 30% annually to cross 47 million sq.ft. during the first three quarters of 2019, exceeding its previous high of 2018(5). Commercial office space continued to be the most sought-after asset class. Some of the major Commercial Property developers In India are Embassy Group, K Raheja Corporation, RMZ Corporation, DLF Developers, Brigade Developers, Salarpuria Sattva, Godrej Properties, Indiabulls Realty, Lodha Group among many others.

Cooling meter market

Currently the entire cooling market in India can be categorized as a submetering market. The concept of district heating/cooling is very new in India but slowly gaining relevance. To say the least, there is only one district cooling plant currently operational in India.

In submetering too, almost 90% market is caters to commercial office space while remaining 10% consists that of retails malls, hospitality, luxury residential projects, etc. Out of this 90% commercial property spaces can be further classified as IT/ITES parks, SEZs, and standalone commercial buildings.

Again, even if there is IT/ITES or SEZ Park, each individual building has its own Chiller plant. For this reason, BTU meter solution is provided for individual buildings rather than clusters of buildings.

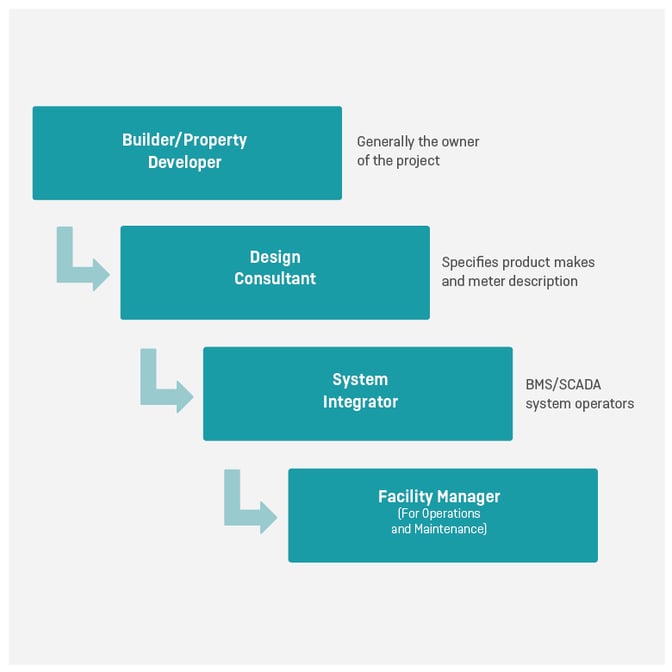

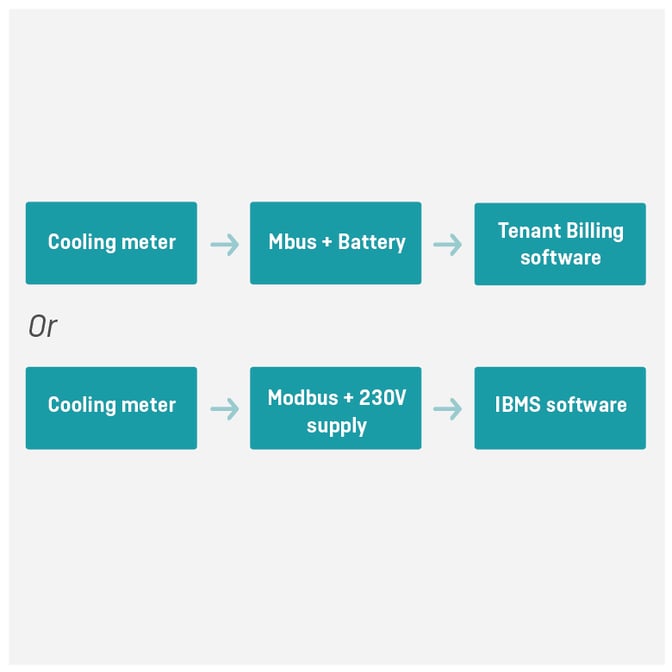

Typically, the solution for buildings in India include cooling meter with communication module and it is either integrated with BMS system or a tenant billing software is used. Unlike most of European countries, the end user in India do not require a lot of analytics to be performed on data retrieved from the meter.

In case of design consultant, the BTU meter scope either falls in HVAC team’s scope or with IBMS team’s scope. While HVAC design consultant mostly specify the BTU meter solution with M-bus Communication module because the meter can be supplied with battery, the IBMS design consultant prefers to specify the BTU meter solution with faster communication modules like MODBUS or BACnet since they prefer to integrate the meters with BMS software.

Key stakeholders involved in a typical cooling energy supply project can be seen as

Hence, the typical system system architecture in India would be

For years, Kamstrup cooling meters built on the extremely reliable ultrasonic technology measure correctly and deliver reliable consumption. Cooling meters can be mains or battery powered. The battery lifetime lasts for up to 16 years. Long term stability, long battery lifetime and a maintenance free energy meter result in very low operational costs and a low total cost of ownership without compromising the data reliability. Kamstrup continues to be a key player with successful installation and operation of more than 20K+ metering points so far. Read more about Kamstrup's cooling solutions. The integrated communication options you get with Kamstrup cooling meters are highly flexible and enable you to achieve true value from the data you receive. Kamstrup’s READy is an effective solution for remote meter reading of smart cooling meters. You get fast and easy access to consumption data and the system gives you access to tools for analyzing and optimizing your distribution network.

Along with the various communication modules we offer for the Indian market, we also hope to see the increase in demand for stand alone automatic meter reading solution as more and more buildings tend to optimize their operations and management of cooling energy

Source

(1) Investopedia.com

(2) www.statista.com

(3) www.ibef.org

(4) India Residential Real Estate 2019 Annual Round-up Report

(5) CBRE : India Real Estate Market Outlook 2019